A few months ago, a friend reminded me I once told him in 2022 that I didn't have any upcoming vacations because I was “trying to hit my savings rate”.

My stomach dropped. Not because of pride, for sure — more like secondhand embarrassment for my past self.

Picture this: me at 11:07pm, blue light frying my eyeballs, Figma still open, Teams set to “available.”

Who optimizes their life so aggressively they skip fun and rest?

Hello, yes: me.

Since 2018 (the second time I discovered FIRE [Financial Independence, Retire Early], another story for another day), I treated it like I’d unlocked the Konami code for life.

Every savings metric tracked and A/B tested, every investment decision benchmarked — and the Google Sheets to prove it.

The formula was simple: automate the index funds, spend as little as possible, and let compounding grow into its name as the eighth wonder of the world.

But my internal operating system had a critical bug: the goalposts were designed to move.

Every time I got close to a milestone, I'd find reasons that it wasn't quite enough. Market volatility, healthcare costs, what if there's a recession, what if, what if…

By that definition, freedom was always N+1 years away.

I was building for a perfect, future-proofed state where every risk was eliminated.

Which, in practice, was building a fortress I was too afraid to leave.

By late 2024, I was running on fumes, though I didn’t know it (or want to admit at the time).

My calendar was a brutal game of Outlook Tetris, my brain stuck in “just one more…”, and I'd caught myself hoping for a severance package that’d buy me some guilt-free time to “figure things out”.

When a layoff didn’t happen fast enough, I requested for unpaid leave; “a sabbatical prototype”, I said to my friends.

For the first time in 15 years, I woke up without an anxiety pit in my stomach.

The night before I was going to make it permanent, I crunched the numbers again.

According to my ultra-conservative formula, maybe 12 months of a proper sabbatical if I lived carefully. Not enough for the picture perfect financial independence that how-to books get written about.

The number felt precarious, not liberating.

And yet, that was the point. If I kept waiting for the moment that felt “safe”, I’d be waiting forever.

So, I quit.

From the outside, it looked reckless. Inside, it felt like stepping off a cliff without a parachute.

Only… I hadn't realized I'd been wearing the parachute all along.

Two months later, while helping a friend with her money planning, I started explaining different types of accounts and investment vehicles.

As I talked through her options, I realized I was giving her permission to count assets I refused to count for myself.

Me? A hypocrite? I could never.

That irony was too much to bear. Later that day, I recalculated everything.

Here's another bug, only now it’s in my internal accounting: only assets I could liquidate tomorrow “counted”. Everything else — CPF, SRS (Singapore's equivalents to 401(k) and Roth IRA) — wasn’t accounted for.

With everything on the table, I scrolled horizontally through the sheet, my own dogmatic rules blurring a little.

It felt like stumbling on a hidden door in a house I thought I already knew by heart.

For a while I just sat with that — the disbelief, the quiet math of it all.

I'd accidentally achieved financial independence months ago.

In fact, I’d crossed that threshold the very month I’d nervously requested for my sabbatical prototype.

I'd been spiraling over bubble tea consumption — 60 cups in six months, for the record — while technically having enough to never climb a corporate ladder again.

The miscalculation wasn't financial. It was psychological.

Recognizing that I’d crossed the line meant confronting that the identity I held so tightly to — sensible fiscal sense, high performing work ethic, high achievement, “good employee” — was optional.

And somehow, stopping felt scarier than continuing. Who was I if I wasn't constantly chasing the next milestone, defined by people who aren’t me?

The math had been right for months, but the permission to believe it was taking the scenic route.

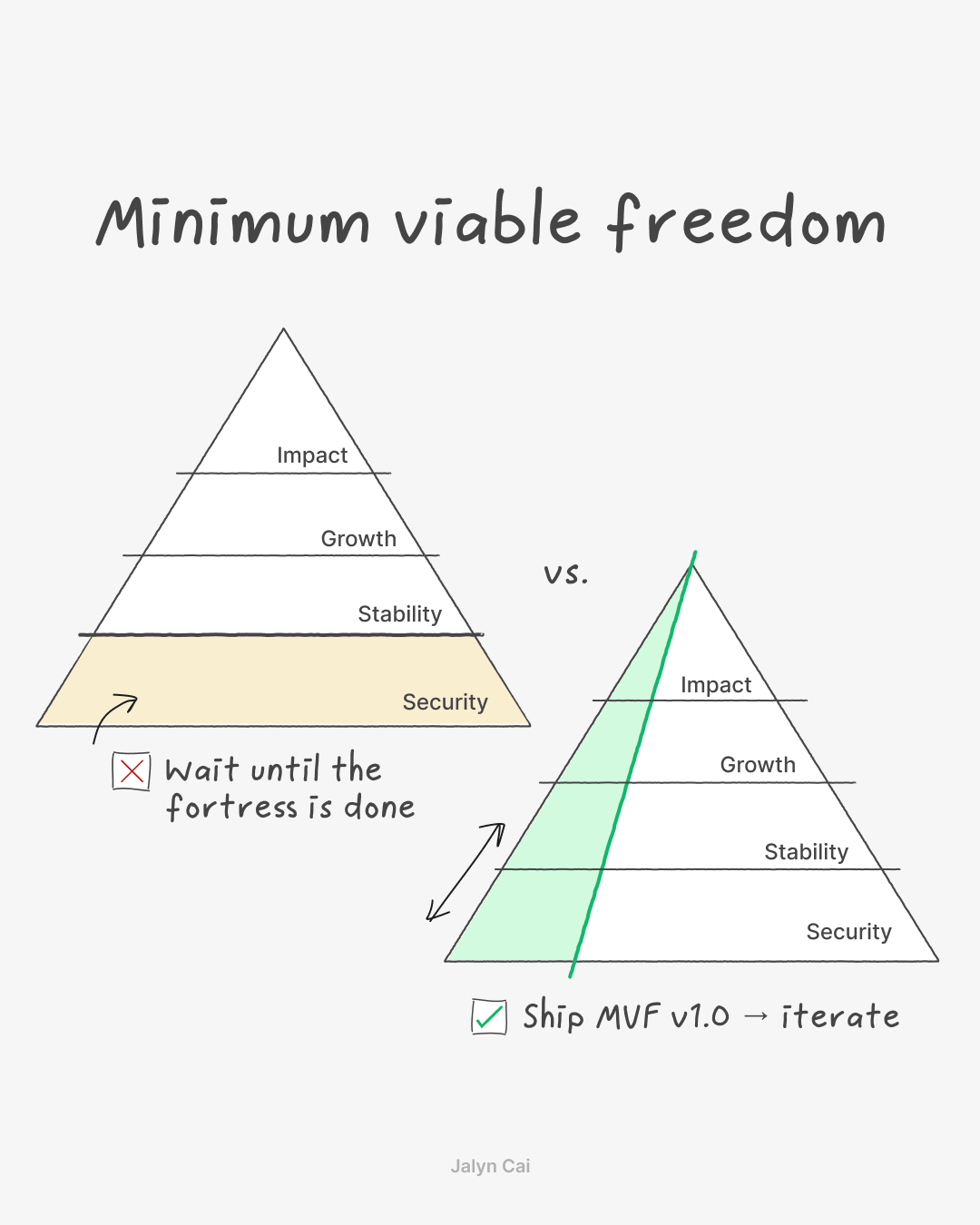

I'd been chasing what I now think of as Maximum Possible Freedom: enough money for every scenario, perfect certainty about what came next.

But what I actually needed was something different. Enough to start, and enough to take the first real step. Not for the entire journey mapped out in advance, but for now.

What I actually needed was Minimum Viable Freedom.

Traditional FIRE says to build the entire fortress: hit a number to last forever, and then — and only then — step outside the default corporate gates.

But freedom isn't a finish line you cross once you're perfectly prepared. It’s something you can actually test and refine, starting with whatever you have now.

I'd already run the experiment: the sabbatical prototype proved I could step away without everything falling apart.

The numbers showed I'd had enough to make it permanent for months. Not enough for every possible scenario, but enough for the life I actually wanted to live.

So I did what I should have done earlier: I stopped optimizing in the abstract, and started living with the real thing.

And yet, old (money) habits die hard:

A friend asked recently how I felt about money now that I’m no longer working full-time.

“Fine,” I said automatically.

Later that night, I caught myself checking my spreadsheet for the third time.

Fine, indeed.

Many FIRE stories end with “this is the number that let me leap”, and sometimes it’s followed up with a quiet confession about still building that fortress; “but I’m afraid it’s still not enough, so I kept working for another 5 years just to be sure.”

Mine's the opposite: I designed the prototype, then leapt. Only in the air did I discover that I’d already built the parachute, and that enough was what I already have; a present-tense reality I finally allowed myself to see.

Minimum Viable Freedom isn’t a number on a chart. It's trusting that you can begin with enough, rather than waiting for everything to be ready.

Other things

In China/Hong Kong (and hung out with

in the latter; gem of a human being 🫶) for the better part of the month!It’s been interesting trying to juggle “being a tourist” and “this is part of my normal life now” (i.e. the writing and full stack stuff). Still working out a portable and scalable system!

My Circular Ring 2 arrived in the nick of time before I flew out, and… I don’t know, man, it’s been a little underwhelming so far with the app (design still matters!!) but I’ll give it a few more days/weeks to calibrate and tell me more useful stuff

On the other hand (well, the same hand actually), I also got a Garmin Forerunner 255, and have been consistently following the Daily Suggested Workout in an effort to improve my cardio health

It’s just funny when it tells me to run for an hour and 14 minutes, then had the audacity to tell me I’ve “overreached” 😐

Until next time,

Jalyn